This is your popup content.

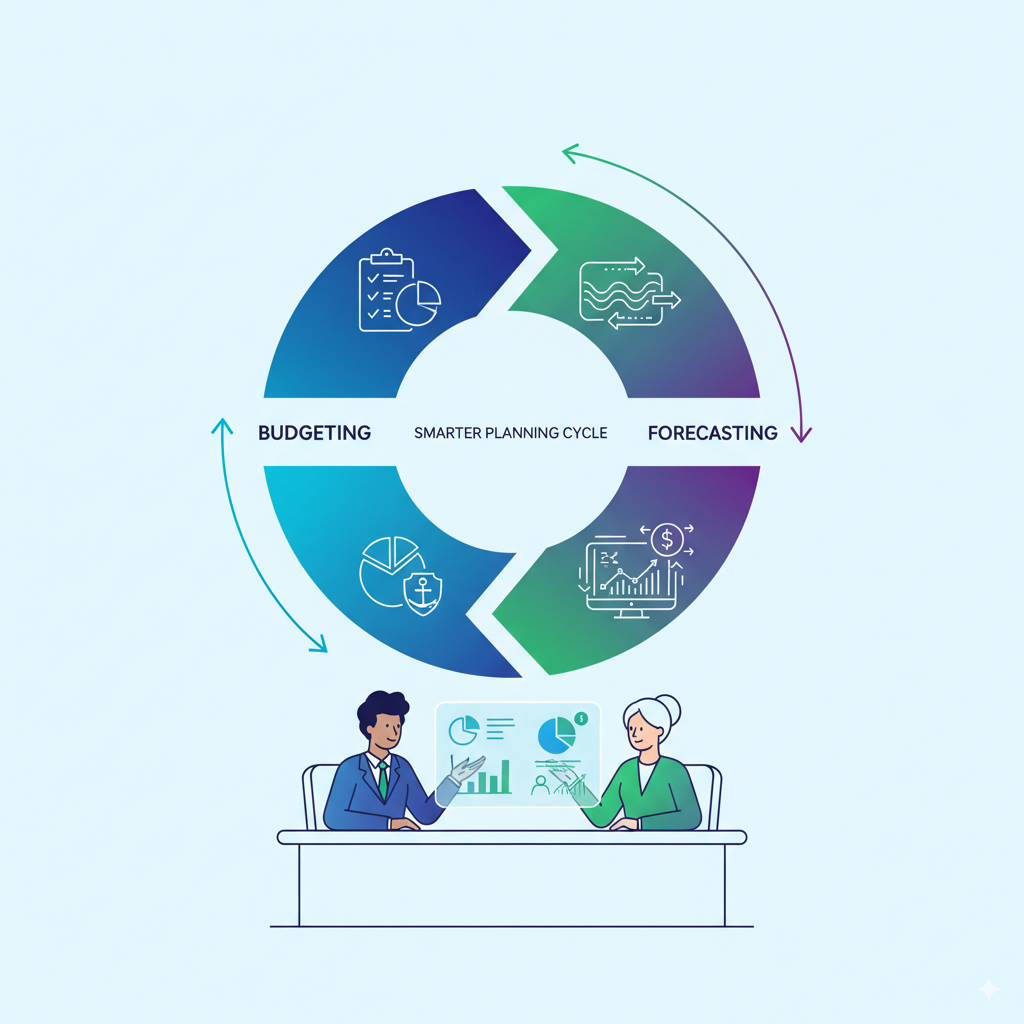

In business planning, the terms budgeting and forecasting are often used interchangeably, but they serve different purposes. For finance managers and business owners in Sri Lanka, understanding the difference is crucial to aligning strategy with accurate financial reporting.

Here’s a breakdown of how budgeting and forecasting compare, when to use each, and why both are essential for effective planning.

A budget is a financial plan for a set period typically a year. It sets targets for revenue, expenses, and cash flow, acting as a roadmap for how a business intends to allocate its resources. Budgets are usually fixed, reviewed periodically, and used as a benchmark to measure performance.

Forecasting, on the other hand, is more dynamic. It predicts future outcomes based on actual performance and market trends. Forecasts are updated regularly quarterly or even monthly to reflect current realities. Unlike a budget, which is aspirational, forecasting is grounded in real-time data.

Together, budgeting and forecasting provide both a financial plan and a performance checkpoint, helping leaders balance ambition with adaptability.

For finance managers, aligning budgets and forecasts ensures reporting is both accurate and actionable. Budgets show where you planned to be, while forecasts show where you are heading. Comparing the two highlights gaps, opportunities, and risks equipping decision-makers with the clarity needed to act.

In a fast-changing economy, relying only on a budget or only on a forecast leaves blind spots. By using both, owners can set realistic targets while staying agile enough to pivot when circumstances change. This dual approach strengthens financial planning and builds confidence among stakeholders.

At Asset BPO, we help businesses in Sri Lanka balance budgeting and forecasting with practical tools and expert guidance. From setting annual budgets to creating rolling forecasts, we ensure your financial planning is both disciplined and flexible.

Ready to strengthen your financial planning?

Reach out today to learn how our budgeting and forecasting support can help you plan smarter and grow with confidence.